HomeSolutionsVenture Capital

Portfolio Intelligence at the Speed of Markets

Transform scattered signals into strategic advantage with AI-powered post-investment portfolio monitoring that captures opportunities before competitors do.

The Hidden Cost of Portfolio Blind Spots

Every day without comprehensive portfolio visibility is a day of missed opportunities and undetected risks.

Real-Time Intelligence Gaps

Portfolio companies evolve rapidly, but your visibility doesn't. Critical performance shifts, market dynamics, competitor developments, and operational challenges remain hidden until quarterly reports. By then, it's often too late to intervene effectively.

Competitive Intelligence Failures

When competitors launch disruptive products or regulatory landscapes shift, your portfolio companies feel the impact immediately. Without continuous market monitoring, these threats can erode portfolio value overnight.

Sub-Optimal Exit Timing

Exit windows are fleeting. Miss the signals of peak valuation, emerging acquirers, or market momentum, and you leave millions on the table. Manual monitoring can't capture these ephemeral opportunities.

Unified Portfolio Intelligence Platform

Risk Llama transforms how VCs monitor, analyze, and act on portfolio intelligence turning reactive oversight into proactive value creation.

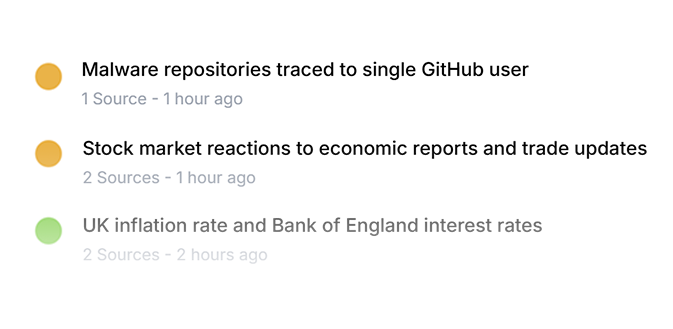

AI Market Watch

Continuous Portfolio Monitoring

Aggregate real-time data from multiple sources, financial metrics, market signals, competitor analysis, news, and operational KPIs into a single command center. See what's happening across your entire portfolio as it happens, not weeks later.

Lluma AI

AI-Powered Risk Detection

Lluma AI continuously scans for patterns, anomalies, and emerging risks across your portfolio. From competitive threats to market disruptions, get alerted to what matters before it impacts valuations.

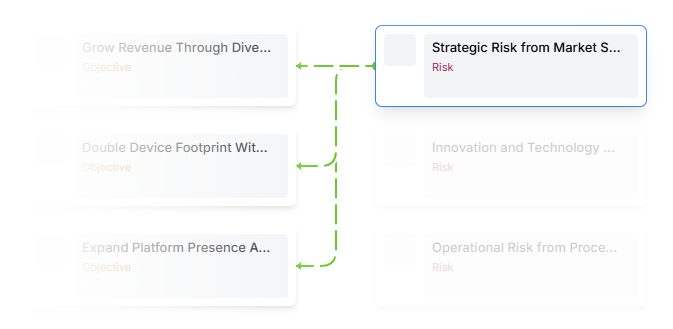

Alignment Map

Strategic Objective Alignment

Link portfolio company performance directly to fund objectives and LP expectations. Visualize how each investment contributes to fund-level goals and identify where to focus your operational support.

Document Scanning

Automated Intelligence Workflows

Replace manual data gathering with automated collection and analysis. Custom alerts notify you of critical developments, while AI-generated insights surface opportunities for value creation or risk mitigation.

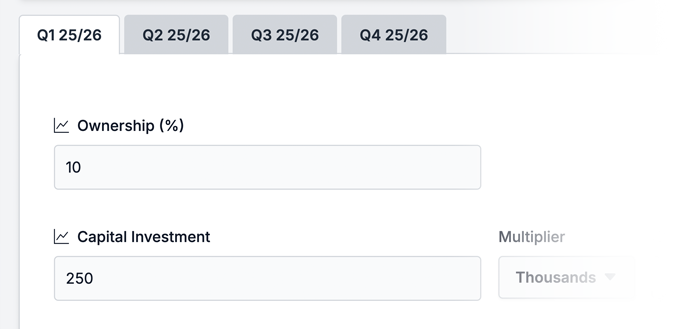

Investment Manager

Exit Opportunity Optimization

Monitor exit indicators across market conditions, strategic acquirer activity, and portfolio company readiness. Risk Llama's predictive analytics help you identify and act on optimal exit windows.

Measurable Portfolio Impact

Leading VCs use Risk Llama to transform portfolio management from reactive to proactive.

75% Faster Risk Detection

Identify portfolio risks weeks before they appear in traditional reporting channels.

3x More Exit Opportunities

Surface strategic exit windows through continuous market monitoring.

60% Time Savings

Automate portfolio monitoring and reporting, freeing partners to focus on value creation.

40% Better Fund Performance

Proactive intervention and optimized exits drive superior returns across the portfolio.

See Your Portfolio Through a New Lens

Join leading VCs who've transformed portfolio blind spots into competitive advantages with Risk Llama.